S&P 500: The Starting Point of Our Top Trio Adventure

Understanding what's the SPY 500 as well as the structure to develop powerful knowledge in the market indexes world.

In our previous blog, we learned the concept of “MARKET INDEX” and with the foundation knowledge that we know have I’m excited to start this new journey a complete guide “TOP TRIO”. This three-part series will explore, analyze and teach you all you need to know about the three more influential market indices in the USA.

The standard and poor’s 500

Nasdaq

Dow jones

Each blog post will focus on one of these indices, exploring their structure, histories and the strategies investor use to navigate them.

Today, we'll be kicking off this series with the S&P 500

The Standard and Poor’s 500 (SPY 500) was founded in 1957 to track the value of the larger 500 companies listed on the NYSE and it is one of the most important market indices in the world. Those 500 companies listed on the S&P 500 can easily represent most of the U.S economy.

Something important to know:

To add a company in the S&P 500 must meet certain liquidity based, size requirements and market capitalization of 12.7 billion or more.

In addition, a company can be removed of the index if the board in this case SPY global determines that is not meeting the standards of the index.

The S&P 500 has quarterly updates also known as “rebalances”. According to Indexology® Blog the spy 500 updates typically affects around 0.8% of the index market capitalization.

The S&P 500 uses a market-capitalization weighting approach, assigning greater proportionate value to firms with the most substantial market values.

APPLE (AAPL)📈: The top holding of the S&P 500

As an example Apple is currently the number one holding of the S&P 500, since the market capitalization (market cap) of Apple is the highest one of all the companies listed in the S&P 500.

Remember, the more valuable a company is, the larger its percentage in the index since it's based on the company's value.

Currently APPLE position in the index is 7.47%.

Formula breakdown: Calculating the Percentage of Any Given Company in the S&P 500 Index.

To calculate the percentage of a company in the S&P 500, we perform the following calculation. In this case, we have selected Apple.

(Market Capitalization of Apple / Total Market Capitalization of S&P 500) * 100.

3.07T/39.71T*100= 7.67% apple percentage in S&P 500

Keep in mind that the percentage of Apple in the S&P 500 fluctuates daily based on Apple's performance and the overall index changes.

Something I want to pinpoint: Apple has a huge % in the index because it is the most valuable company in the world. There are companies that have a % of 0.01 or even less all depends on their market cap, as I said. 😃

To conclude this part: here’s a picture of the TOP 10 HOLDINGS of the S&P 500.

Interesting fact 🤔: The 10 top holdings with a combined value, are nearly 8.5 trillion dollars. Which is about 28% of the total S&P 500 index!!

Time to take action 👊🏻

Now that we know more about the S&P 500, I believe this index is a good one to invest your money. Since it has diversification and by investing in this index you are basically investing in the most powerful companies of the US economy.

To convince you more:

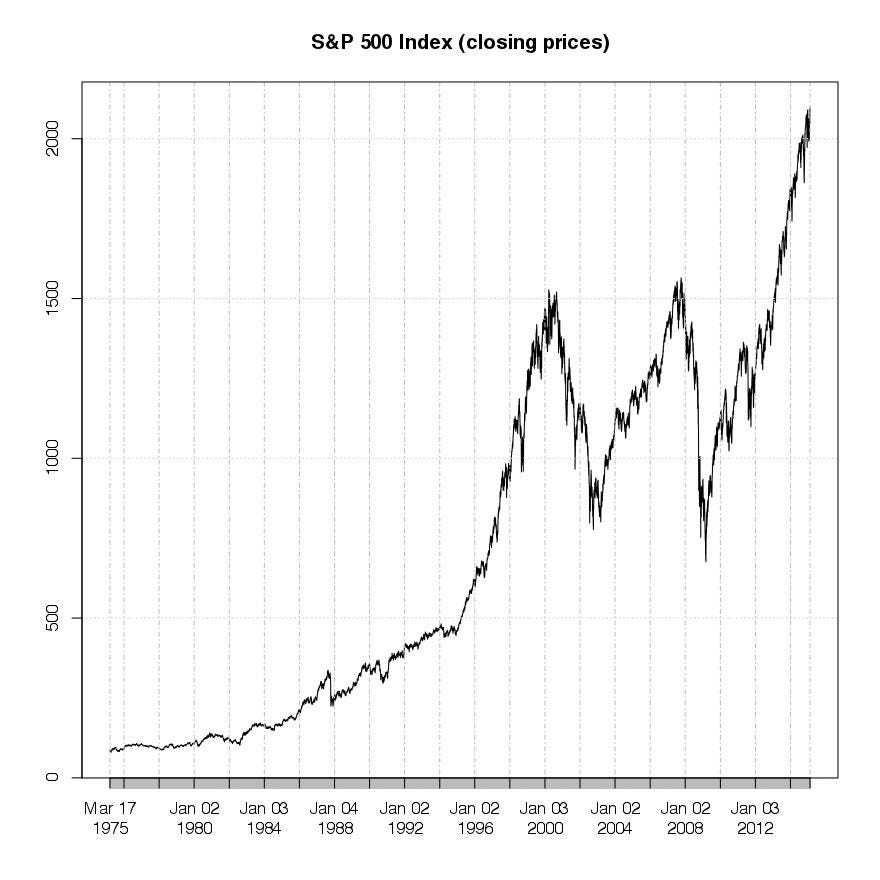

From January 1975 until January 2015 (40 years), the S&P 500 index produced an annualized growth rate of 11.9%.

Meaning that just $ 2,400 a year ($ 200 per month) invested and left to ride would have grown to $ 1,515,5422 by 2015.

Heads Up! Before diving into investment, it's crucial to evaluate your risk tolerance, and keep in mind that there are no absolute certainties in the stock market.

If you do your research and decide to invest in S&P 500 here are 2 ways to do so:

Exchange-Traded Funds (ETFs): The most straightforward way to invest in the S&P 500 is through ETFs like the SPDR S&P 500 ETF (SPY).

Index Mutual Funds: Index mutual funds, such as the Vanguard 500 Index Fund (VFIAX), also aim to mimic the S&P 500.

Here’s a video of Warren buffet (the best investor of all time) recommending to his wife where to invest her money.

To Wrap-up

The S&P 500 market index has been around for many years, serving as one of the most crucial market indices not only in the USA, but also worldwide 🌏. With this post, we conclude the first installment of our trilogy, the “TOP TRIO”. I hope you find the interesting and it helps you understand the market better. Let’s grow our financial knowledge all together!!

BE PART OF THE WISEWEALTH FAMILY

Sources: Finasko and Investopedia