The Dow Jones: An Adventure Through Time

From 12 Stocks to 30: The Transformative Journey of the Dow Jones Industrial Average.

I hope everyone enjoyed their weekend. Today, we are learning about the "Dow Jones" market index, the last one of the TOP TRIO. As with all beginnings, they eventually come to an end. This is the final market index we'll be discussing in this TOP TRIO saga/trilogy.

What knowledge will you gain after reading this blog:

Understanding the Dow Jones Industrial Average (DJIA)

Learn about the DJIA's price-weighted approach and how it tracks 30 large, publicly-owned blue-chip companies on the NYSE.

Historical Evolution of the DJIA

Discover the origins of the DJIA, its creators Charles Dow and Edward Jones, and its evolution from 12 to 30 companies.

Price-Weighted Index Explained

Understand the significance of a price-weighted index and how higher-priced stocks have a greater impact on the DJIA.

Comparative Insights of Major U.S. Indices

Gain insights into the performance of the DJIA, S&P 500, and Nasdaq over a 30-year period and see how they stack up against each other.

Investment Opportunities in DJIA

Explore two ETFs that allow you to invest in the DJIA and understand their significance.

With that said, let’s start with the what is the Dow Jones Industrial Average?

The Down Jones Industrial Average is a stock market index that tracks the 30 large, publicly owned blue-chip companies trading on the New York Stock Exchange (NYSE)

According to Investopedia: Some critics argue that it is too narrow to represent the state of the overall U.S. economy.

Origin and Evolution of this index:

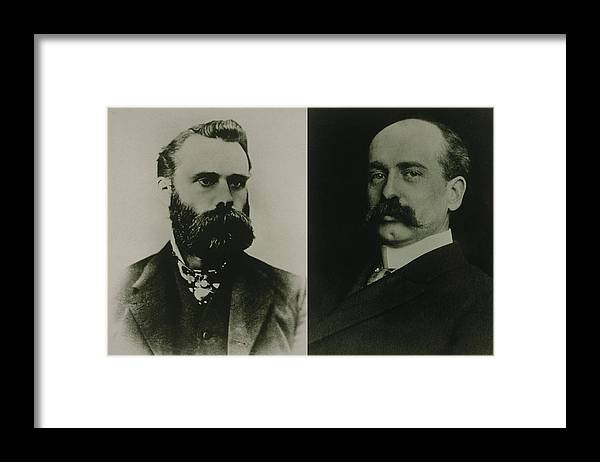

The "Dow Jones Industrial Average," also known as Dow Jones, was created by journalist Charles Dow and his business partner, Edward Jones. They established the Dow Jones Industrial Average in 1896, starting with just 12 companies in the industrial sector.

The number of companies in the index increased to 20 in 1916 and then to the current level of 30 companies in 1928.

In addition, this market index is one of the most important indexes in the U.S, and here are some Historical Achievements of this index:

March 15,1933: The largest one-day percentage gain occurred during the market turmoil of the 1930s, when the Down increased 15.34%, up 8.26 points to close at 62.10.

Oct 19, 1987: The day of the Dow's largest one-day % drop came to be known as Black Monday, since the index fell 22.6%. An interesting fact is that the exact causes of the crash remain mystery.

Test your knowledge 🧠

At the end of the blog, you'll find the correct answer. Check to see if you were right!

November 16, 2020: The Dow exceeded 30,000 points for the first time, closing at 30,046.24, and in January 5, 2022: The Down hit its all-time high of 36,952.65

Interesting fact 🧐

The DJIA (that is the symbol of the Dow jones) has consistently hit new highs over the 2010s. The longest bull market in history lasted approximately 11 years from March 2009 and ending in Feb.2020. (Investopedia)

A mindful thought 💭

As I've mentioned before, we're on this learning journey together. I always execute thorough research before sharing insights that I believe will be most valuable to you, my WISE WEALTH READERS. I aim to highlight the most crucial aspects of this index. Remember, I'm not an expert; I'm just someone excited to share my journey and contribute to our community. I firmly believe that the more you give, the more you receive, and my primary goal is to offer valuable to my readers.

Okay, okay, I think I'm changing my direction. Let's get back to it

The Magnitude of DJIA's Data: A Detailed Review and Its Benchmarking Against S&P 500 and Nasdaq.

The DJIA is a price weighted index, uses the price per share for each stock included and divides the sum by a common divisor, usually the total number of stocks in the index. (Investopedia)

Which means that the higher-priced stocks have a greater impact than the lower-stocks.

For example:

Stock A represents 60% of the index.

Stock B represents 40% of the index.

The price-weighted index method gives more weight to stocks with higher prices. So, if Stock A has a higher price than Stock B, it will have a larger representation in the index, as illustrated in the chart.

In fact, here is a link to see the 30 companies ranked by their weight in the index: To give you a heads ups here are the top 3 companies:

United health group: 10.49% weight in the index.

Microsoft: 6.46% weight in the index.

Goldman Sachs 5.91% weight in the index.

Since the Down jones was created companies have come and gone. For example, Citigroup and General Motors were removed from the Dow in the wake of the financial crisis, replaced by Cisco Systems and Travelers. (The Motley Fool)

Comparative Insights:

The Dow Jones returned 8.52% over 30 years from 1991 to 2021. To provide a better analysis, let's compare it with the other two indices from our "TOP TRIO" trilogy:

The S&P 500 returned 8.44 % during the same period.

Nasdaq returned 11.91% during the same period.

For a better understanding, here is a here's a visualization of the returns of these major indices from 1991 to 2021:

As seen in the graph above, the Nasdaq was the index that performed the best, yielding a return of 11.91% over 30 years. Compared to the Dow Jones, it provided 3.39% higher returns.

Which means that the Technology sector did pretty well over those 30 years.

To conclude this section, it doesn't necessarily mean that the Nasdaq will outperform the other two indices in the next 30 years. Personally, my favorite of the 3 is the S&P 500, as it offers greater diversification compared to the Dow Jones and Nasdaq.

Two ways to invest in the Dow Jones Industrial Average.

There are plenty of financial instruments do invest in this index, however today I will give two ETF´s where you can invest in the DJIA.

Disclaimer:

As I always mentioned, you should always do your research before taking any investment decision.

Disclaimer: This content is for educational purpose only and should not be considered any investment advice.

My closing take…

I hope you found this article interesting. I certainly did; while writing, I learned a lot of new information about this market index that I wasn't previously aware of.

With this post, we conclude our discussion on the three most important indices in the US, wrapping up our 'TOP TRIO' trilogy. Please let me know if you have any suggestions or questions.

I'm looking forward to our next miniblog on Friday and our main blog next week.

Now, a significant takeaway for you: The Dow Jones was created by two individuals, Charles Dow and Edward Jones, which is why it's called the DOW JONES.

Sources: Investopedia, The Motley Fool and Etftrends.

And I haven't forgotten about the right answer for the poll. It is:

Biggest gain: March 15,1933